Custody

Partnerships

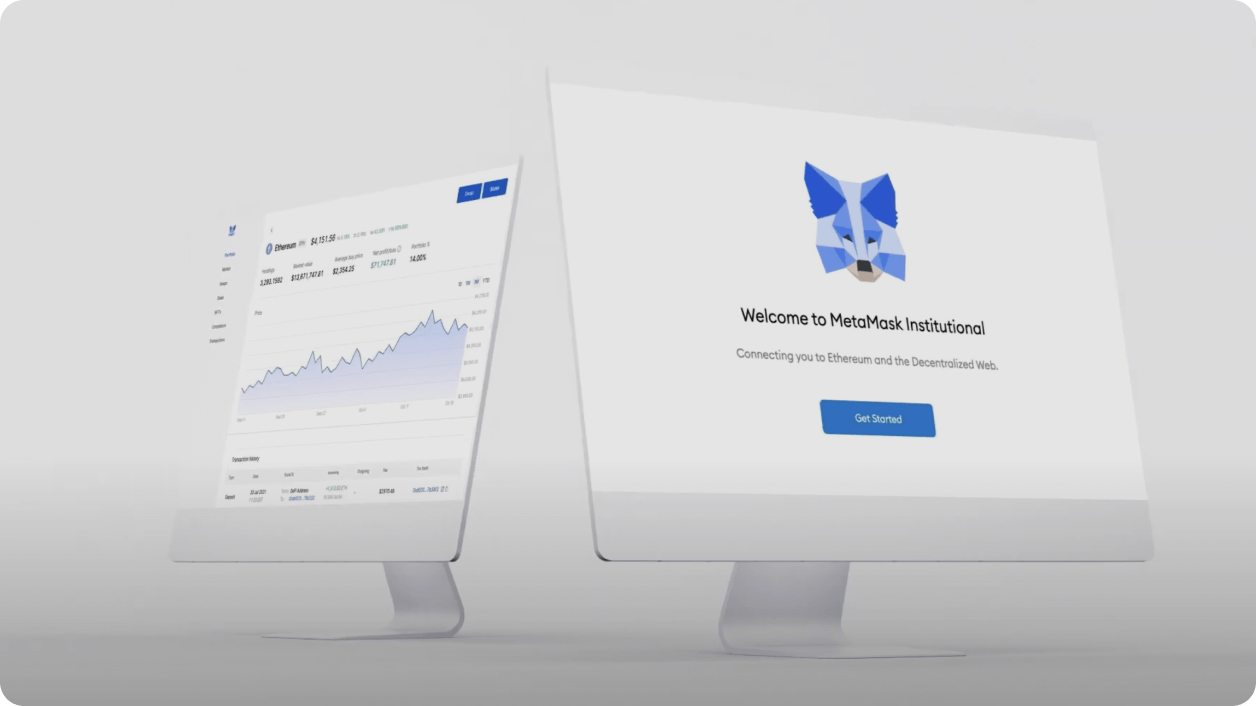

Hundreds of organizations execute transactions across DeFi and Web3 protocols using MetaMask Institutional alongside their custodian’s platform. See how they do it.

The Widest Range of Top-Tier Crypto Custody and Self-Custody Solutions

Custody plays a fundamental role for organizations seeking to access crypto and DeFi. Depending on the range of services offered by a qualified custodian or custody technology provider—they may cover everything from institution-compliant key storage and interaction with broker dealers and exchanges, to multi-signature transaction approval and signing. They are paramount to organizations safely acquiring and holding crypto assets.

MetaMask Institutional is the only multi-custodial institutional Web3 wallet. We integrate with most expansive suite of custody and self-custody solutions on the market to meet all variation of institutional-grade custody requirements.

Are you a crypto-custodian interested in integration?

Solutions Fit for Global Jurisdictions and Diverse Key Management Requirements

BitGo BitGo is a global leader in custody and security solutions with over $64B in assets under custody. Founded in 2013, BitGo pioneered the multi-signature wallet and is the first digital asset company to focus exclusively on serving institutional clients. BitGo provides the security and operational backbone for more than 500 institutional clients in 50 countries, including the world’s top cryptocurrency exchanges and platforms.

- Type: Qualified Custodian, Multisig Contract Wallet

- Supported Chains: Ethereum and Avalanche (C-Chain)

- Supported Tokens: ERC-20, ERC-721, and ERC-1155 tokens

- Headquarters: USA

- Coverage: Global (Licenced in South Dakota, New York, Switzerland and Germany)

- AUC: >$64 Billion

Cactus Custody™ Cactus Custody™ is a trust company based in Hong Kong with over $10B in assets under custody. It is the third-party institutional custody service provided by Matrixport, Asia’s fastest growing digital assets financial services platform. Cactus Custody™ offers cold and warm storage, enterprise crypto management features, and DeFi connectivity as well as protocol whitelisting services for miners, corporates, funds, and projects.

- Type: HK Trust Bank, Hardware Security Module (HSM)

- Supported Chains:

EVMs: Ethereum, Arbitrum, Avalanche, BNB Smart Chain, Fantom, Heco, Klaytn, Polygon, Smart Bitcoin Cash Non-EVMs: BSV, Bitcoin, Bytom, Decred, Dogecoin, eCash, Ethereum Classic, Filecoin, Polkadot, Kusama, Litecoin, Stellar, TON, Tron, Zcash

- Supported Tokens: ERC-20, ERC-721, and ERC-1155 tokens

- Headquarters: Hong Kong

- Coverage: Global

- AUM: >$10 Billion

Cobo Cobo is a globally trusted leader in digital asset custody solutions. As the world’s first omni-custody platform, Cobo offers the full spectrum of solutions from full custody, co-managed MPC custody, to fully decentralized custody as well as wallet-as-a-service, advanced DeFi investment tools and an off-exchange settlement network. Trusted by over 500 institutions with billions in assets under custody, Cobo inspires confidence in digital asset ownership by enabling safe and efficient management of digital assets and interactions with Web 3.0.

- Type: Multi-Party Computation (MPC), Hardware Security Module (HSM), Smart Contract

- Supported Chains:

EVMs: Ethereum, Aurora, Avalanche, BNB Smart Chain, Fantom, Heco, Polygon Non-EVMs: Algorand, Bytom, Cardano, Eos, Filecoin, Kusama, NEAR, Polkadot, Solana, Tron, and others

- Supported Tokens: ERC-20, ERC-721, ERC-1155 tokens and others

- Certification: SOC2 Type 2

- Headquarters: Hong Kong

- Coverage: Singapore

- AUM: $3B

Fireblocks Fireblocks is an easy-to-use platform to build innovative products on the blockchain and manage day-to-day crypto operations. Our platform is trusted by thousands of leading companies across financial services and Web3 to power their digital asset business, from secure wallet infrastructure and key management to treasury operations and DeFi trading.

- Type: Direct Custody with MPC-CMP and Secure Enclaves

- Supported Chains: 40+ EVM and non-EVM Blockchains

- Supported Tokens: Support for every major token standard, such as ERC, BEP, SPL, and more

- Certification: CCSS Type III Qualified Service Provider, SOC 2 Type II, ISO 27001, 27017, and 27018

- Headquarters: New York

- Coverage: Global

- AUM: $45B with $4T+ transaction volume

GK8 GK8 is a blockchain cybersecurity company that offers financial institutions an end-to-end platform for managing blockchain-based assets on their own. The company developed a patented Multi-Party Computation (MPC) solution and the world’s first true air-gapped Deep Cold Vault that enables its clients to create, sign, and send secure blockchain transactions without internet connectivity, eliminating all cyber attack vectors.

- Type: Multi-Party Computation (MPC)

- Supported Chains: All EVMs and Layer 2s

- Supported Tokens: ERC-20 and ERC-721 tokens

- Certification: SOC2 Type 2

- Headquarters: Israel

- Coverage: Global

- AUM: >$10 Billion

Hex Trust Hex Trust is the leading fully-licensed, SOC2 compliant, and insured provider of institutional-grade digital asset custody in Asia. Led by veteran banking technologists and award-winning financial services experts, Hex Trust has built Hex Safe™, a proprietary bank-grade platform that delivers custody, cold storage, DeFi, brokerage services, and financing solutions for financial institutions, digital asset organizations, corporations, and private clients.

- Type: HK Trust Bank, Hardware Security Module (HSM)

- Supported Chains:

EVMs: Ethereum, Celo, Flare, Hedera, Klaytn, Polygon, Songbird Non-EVMs: Algorand, Bitcoin, Bitcoin Cash, Polkadot, Ripple, Stellar, Terra, Terra Classic, Tezos

- Supported Tokens: ERC-20, ERC-721, ERC-1155 tokens

- Certification: SOC2 Type 2

- Headquarters: Hong Kong

- Coverage: Global

- AUM: >$5 Billion

MPCVault MPCVault is a multi-signature, MPC wallet utilized by organizations ranging from Web3 treasury managers, centralized exchanges, fiat-to-crypto bridges, hedge funds, venture capital funds, and more. Presently, over 80 companies use MPCVault as their team wallet to manage assets across different chains, interact with dapps, and handle payrolls, payments, and accounting. MPCVault has over $500M in assets secured by the platform and has facilitated over $3B in transactions in 2023. The founding team has expertise in cryptography and computer security. MPCVault also holds a patent for achieving hardened derivation in multi-party computation.

- Type: Multi-Party Computation (MPC)

- Supported Chains: BTC, ETH, MATIC, BNB, AVAX, ARB, OP, TRX, APT, SUI, Base, SOL

- Supported Tokens: We support all tokens and token types on the blockchains we support. Even if you just minted a new NFT or your own token!

- Certification: SOC2 Type 2

- Headquarters: USA

- Coverage: Global

- AUM: ~$600m with over $3B in transactions during 2023

Safe Safe is the safety standard of Web3 and the most trusted platform to manage digital assets for individuals and communities on EVM-compatible chains. It is a programmable account that enables users to control their digital assets with much more granular permissions, starting with multiple-signature (multi-sig) as the baseline permission. Safe stores ~$40B USD worth of digital assets today.

- Type: Multisig Contract Wallet

- Supported Chains: Ethereum, Arbitrum, Aurora, Avalanche, BNB Smart Chain, Energy Web Chain, Gnosis Chain / xDai, Optimism, Polygon

- Supported Tokens: ERC-20, ERC-721, and ERC-1155 tokens

- Headquarters: Switzerland

- Coverage: Global

- AUM: ~$40 Billion

DISCLAIMER: MMI IS OFFERED BY CONSENSYS SOFTWARE INC. AND CONSENSYS DOES NOT OFFER CUSTODIAL SERVICES. CONSENSYS MAKES NO REPRESENTATIONS NOR DOES IT WARRANT, ENDORSE, GUARANTEE OR ASSUME RESPONSIBILITY FOR ANY OTHER SERVICE ADVERTISED OR OFFERED BY A THIRD PARTY ON OR AVAILABLE THROUGH THE MMI SERVICES, UNLESS OTHERWISE AGREED IN WRITING. YOU SHOULD USE YOUR JUDGEMENT, EVALUATE SUCH THIRD-PARTY SERVICES INDEPENDENTLY, AND EXERCISE CAUTION WHERE APPROPRIATE.