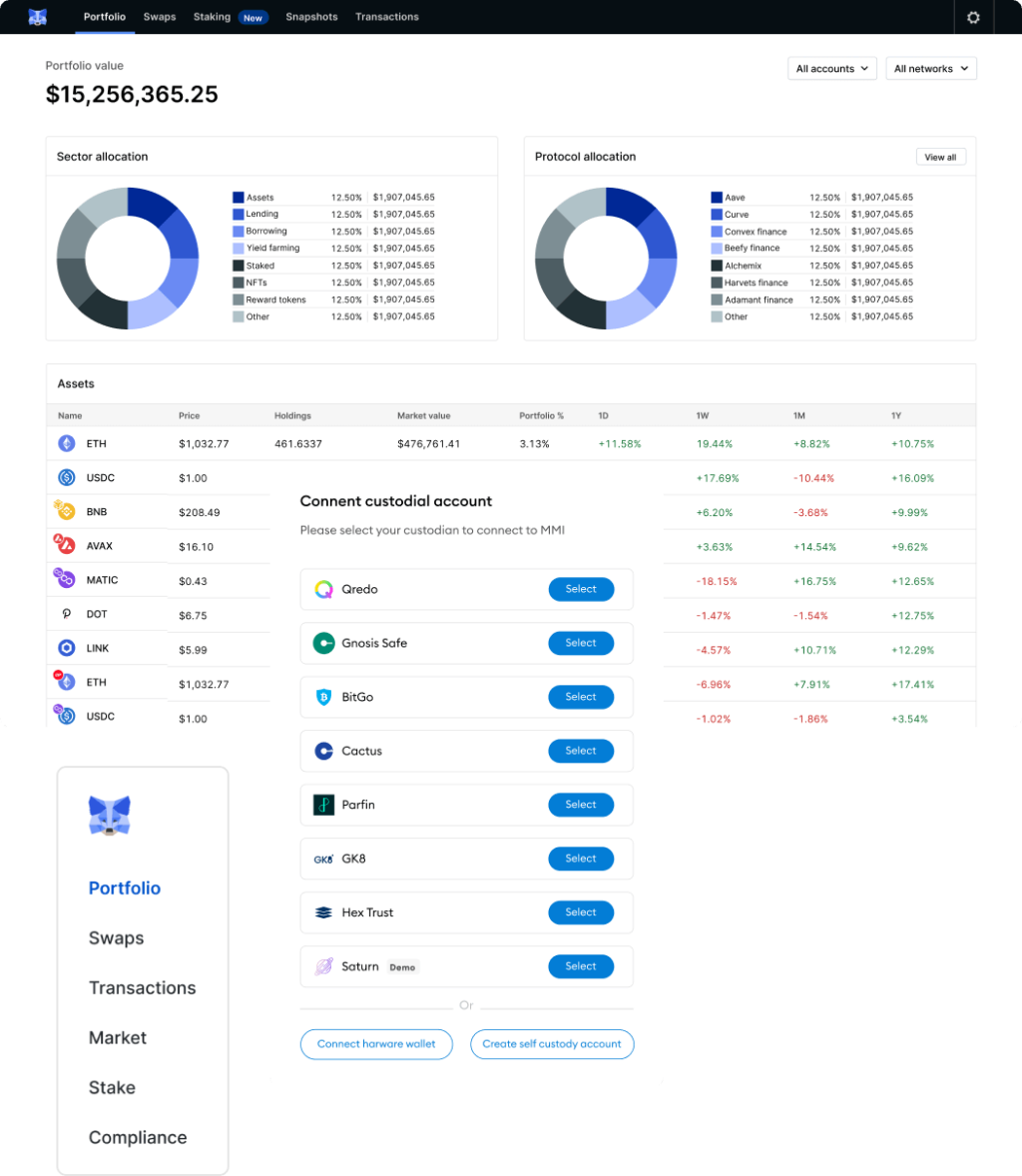

Work with a custodian that matches your needs

MetaMask Institutional is partnered with eleven top-tier custody and self-custody providers. Together, our partners provide global coverage and diverse tech stack offerings to meet all variations of institutional-grade custody requirements.

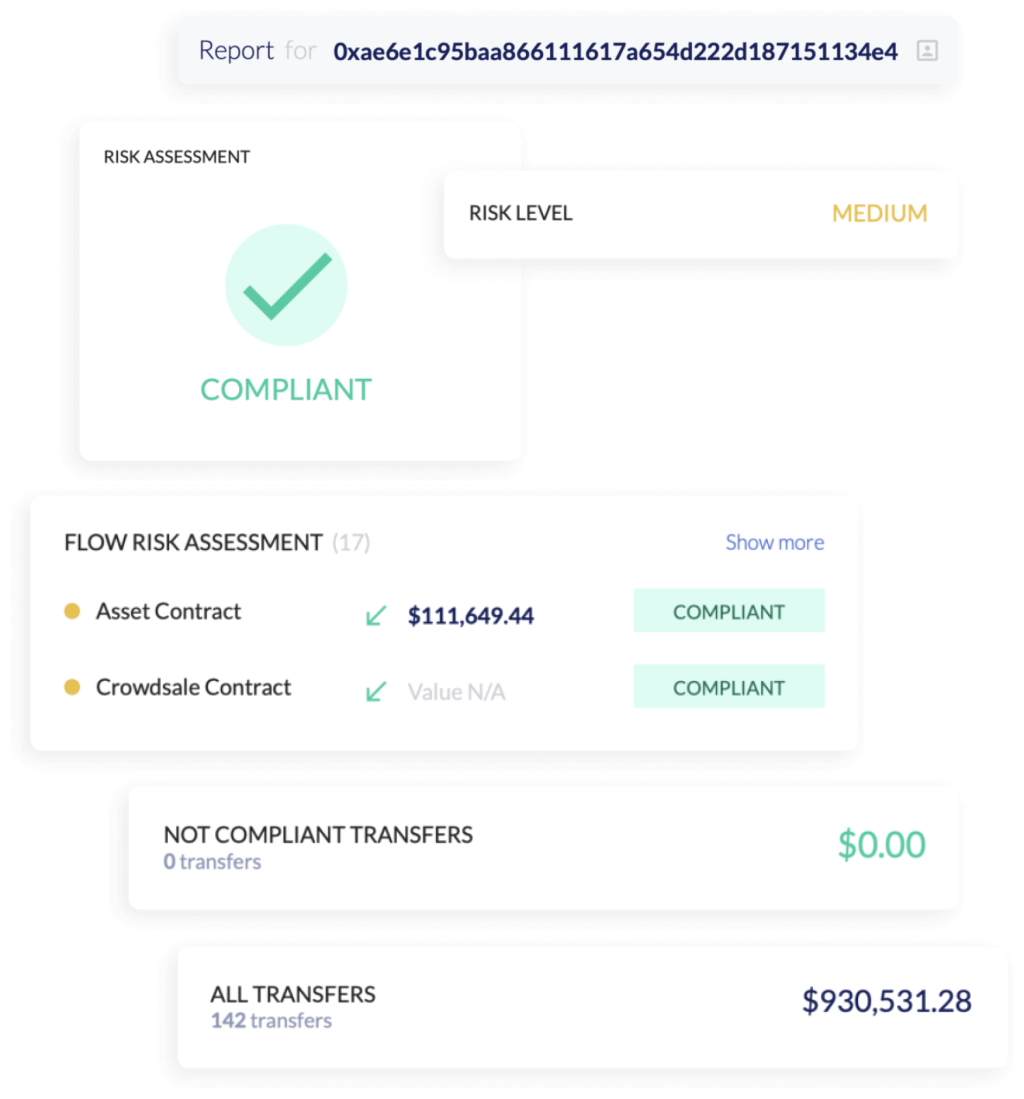

Assess pre- and post-trade compliance risks

Run assessments on wallet and smart contract address or DeFi pools. Leverage know-your-transaction (KYT) frameworks to ensure compliance with organizational policies and global regulations across your Web3 interactions.

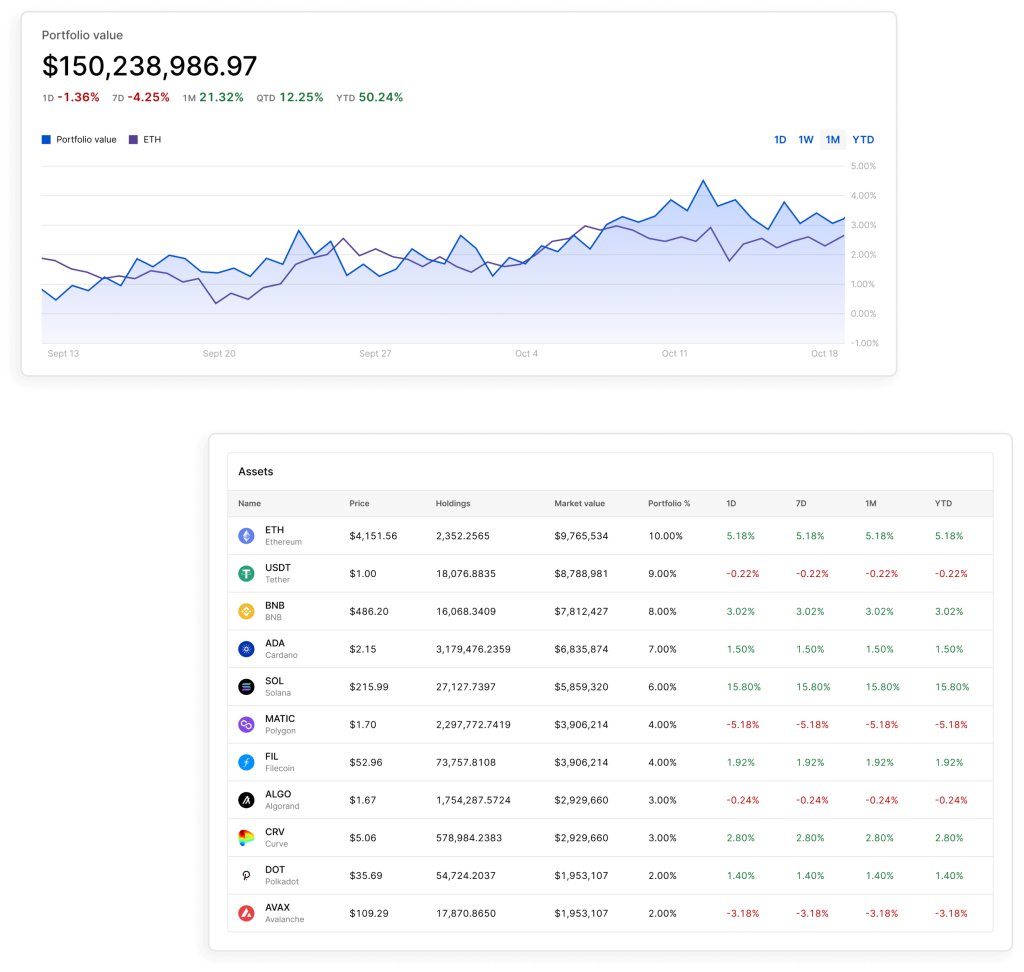

Streamline reporting to fund admins, auditors, and tax accountants

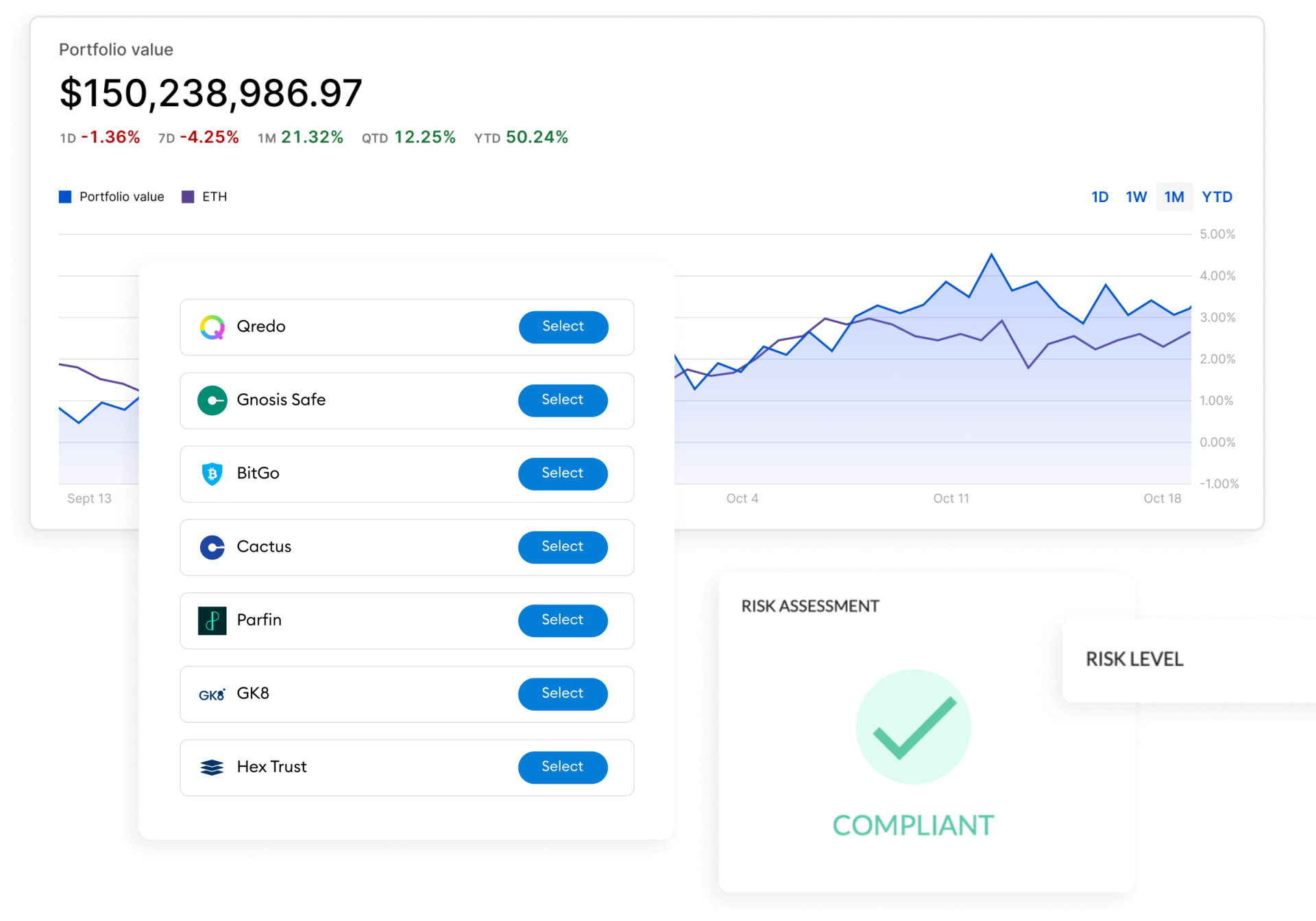

On the Portfolio Dashboard, you can view your transaction history and get snapshots of weekly, monthly and quarterly valuations, as well as provide read-only access and CSV downloads to your treasury portfolio valuation. On browser extension and mobile, you can input reference notes for each transaction.

Interact with over 17,000 web3 protocols and applications

MetaMask serves over 30M monthly active users and is connected to almost every web3 dapp. Trade, invest, stake, lend, borrow, provide liquidity, and bridge assets across EVM chains.

Why TradFi organizations

love MetaMask

Institutional

love MetaMask

Institutional

- All of MetaMask

- Use MMI to gain access to all of Web3

- Multi-chain Access

- Bridge assets and trade across EVM chains and L2s

- Custody Options

- Work with one of our top-tier custody and self-custody partners to help manage key storage, facilitate multi-signature transaction approvals, and optimize trade flows

- Holistic monitoring

- Get a consolidated view of all assets across 13 EVM chains on the Portfolio Dashboard

- Detailed transaction reporting

- Streamline reporting to fund admins, auditors, tax accountants, and other 3rd parties