Launch of seat-based pricing

Launch of seat-based pricing

- New pricing model based on an organisation’s seat count

Since launch in February 2021, MetaMask Institutional’s goal has been to bridge all organizations into DeFi and Web3. Each month, the developers behind MMI ship features large and small to improve the investor experience, and further facilitate organizational engagement in the ecosystem.

This is a log of their accomplishments and the impact they will bring to MMI users.

Launch of seat-based pricing

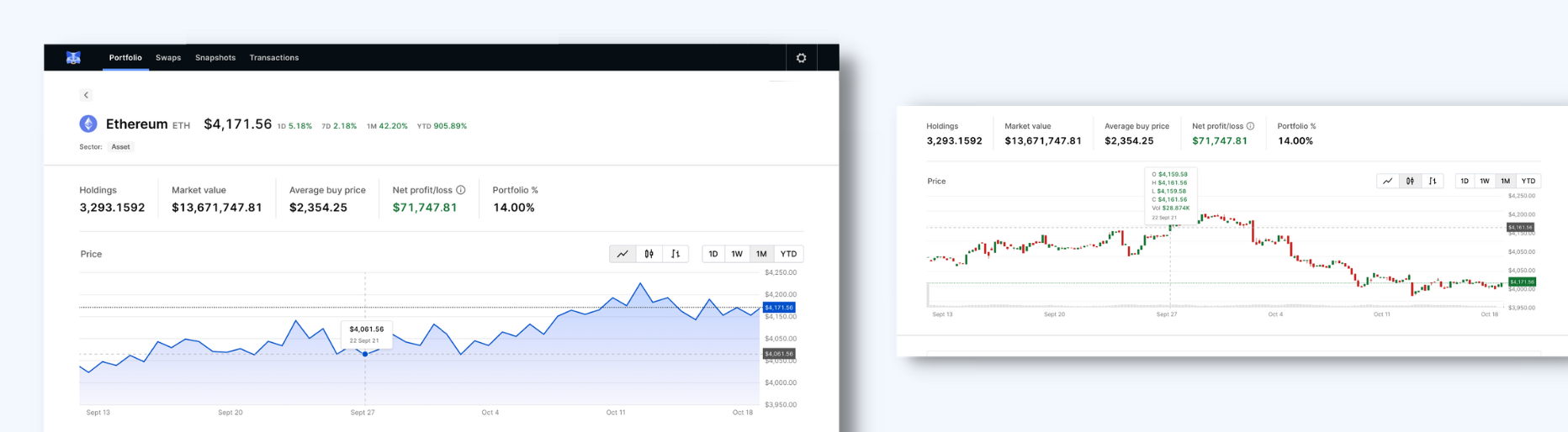

Revamp of MMI’s portfolio dashboard

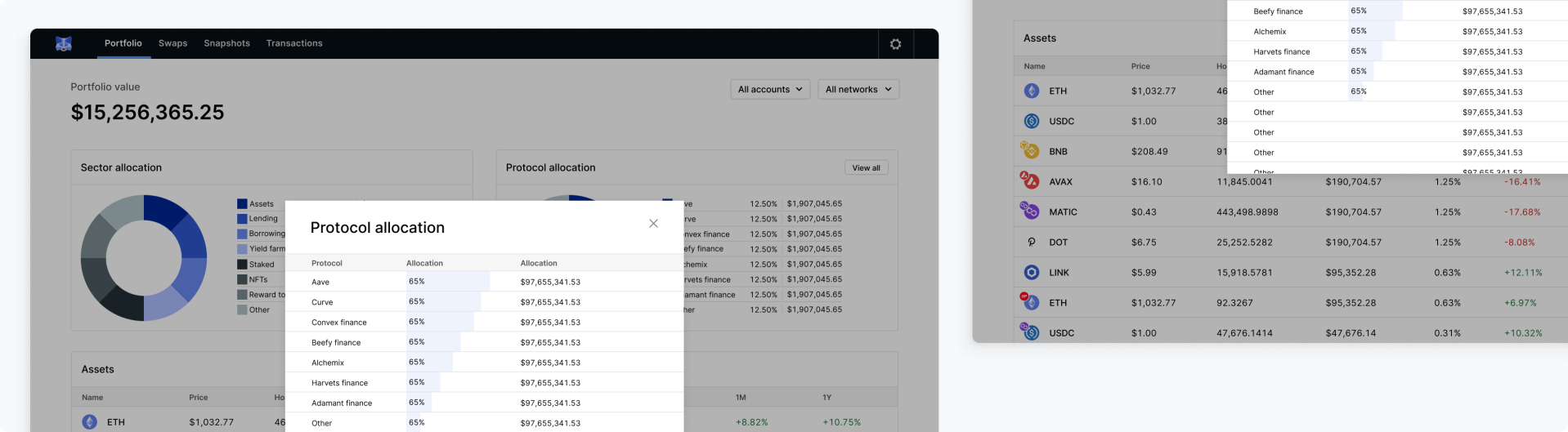

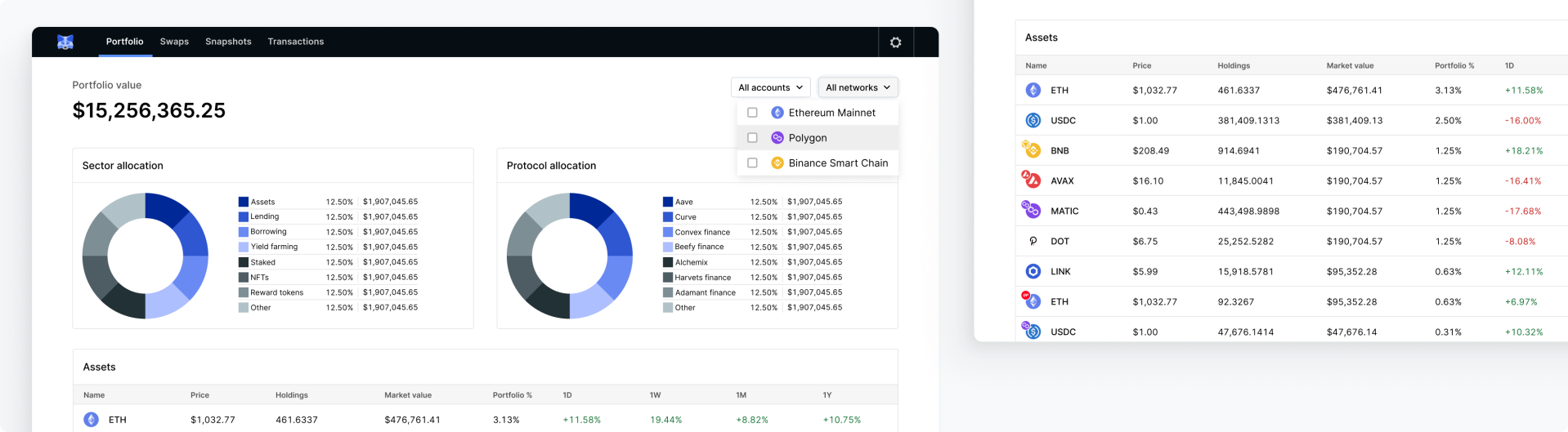

Users are able to change their portfolio view by protocol or sector

Pay invoices from the Portfolio Dashboard

Download Portfolio holdings to CSV

APIs, DeFi adapters and CeFi Portfolio Dashboard

Account Management

Solana support on the Portfolio Dashboard

Improved Transaction History

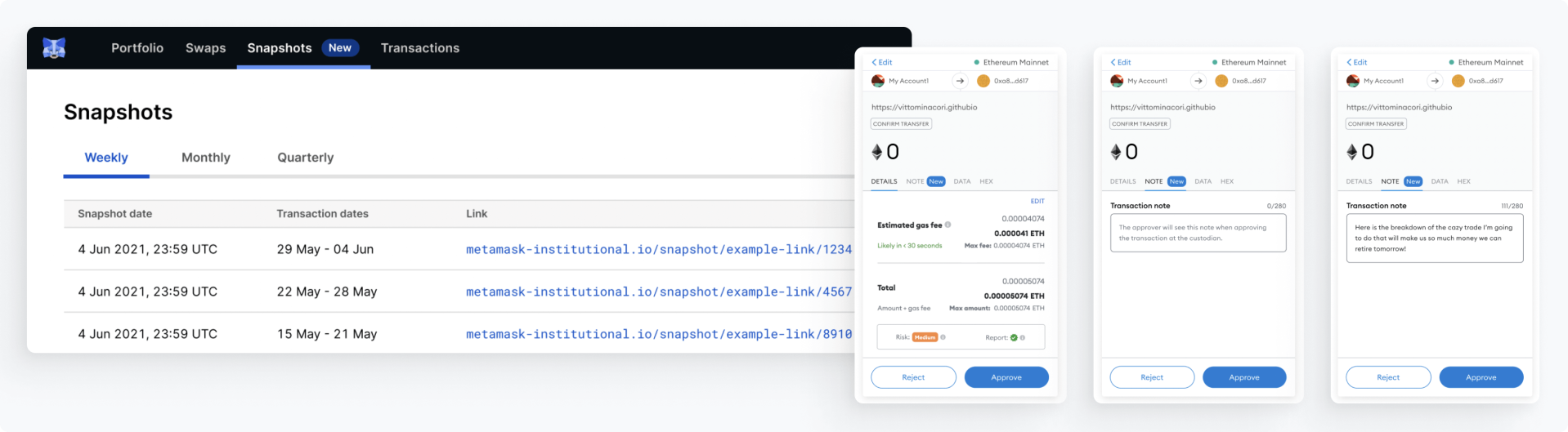

Improved Portfolio Snapshots

MetaMask Institutional Integrates With MPCVault

MetaMask Institutional partners with self-custody wallet MPCVault to provide organizations of any size with access to DeFi that fulfills institution-required security, operational efficiency, and compliance needs.

See further details and announcement here.

Snaps is live on MMI and revamped extension UI

MMI users can now officially install and use a variety of Snaps available on snaps.metamask.io. We have also revamped the MMI extension UI which now provides a more streamlined user experience.

Improved onboarding and launched Crypto Payments

We've reduced time to onboarding by 6X for our users, and launched Crypto Payments for ETH and USDC as the default payments method in MMI. The monthly invoice sent to you will provide instructions on where to transfer the ETH or USDC to.

Integrated Figment in Staking marketplace

MMI integrated Figment, a leader in staking infrastructure, and the largest non-custodial ETH staking provider into our Staking marketplace. The addition of Figment brings MMI’s offering to five aggregated institutional staking providers.

MetaMask Institutional Integrates with Fireblocks

The integration brings together two prominent web3 powerhouses to provide the most complete enterprise-grade wallet security and portfolio management solution for institutional investors and builders.

Read the full press release here.

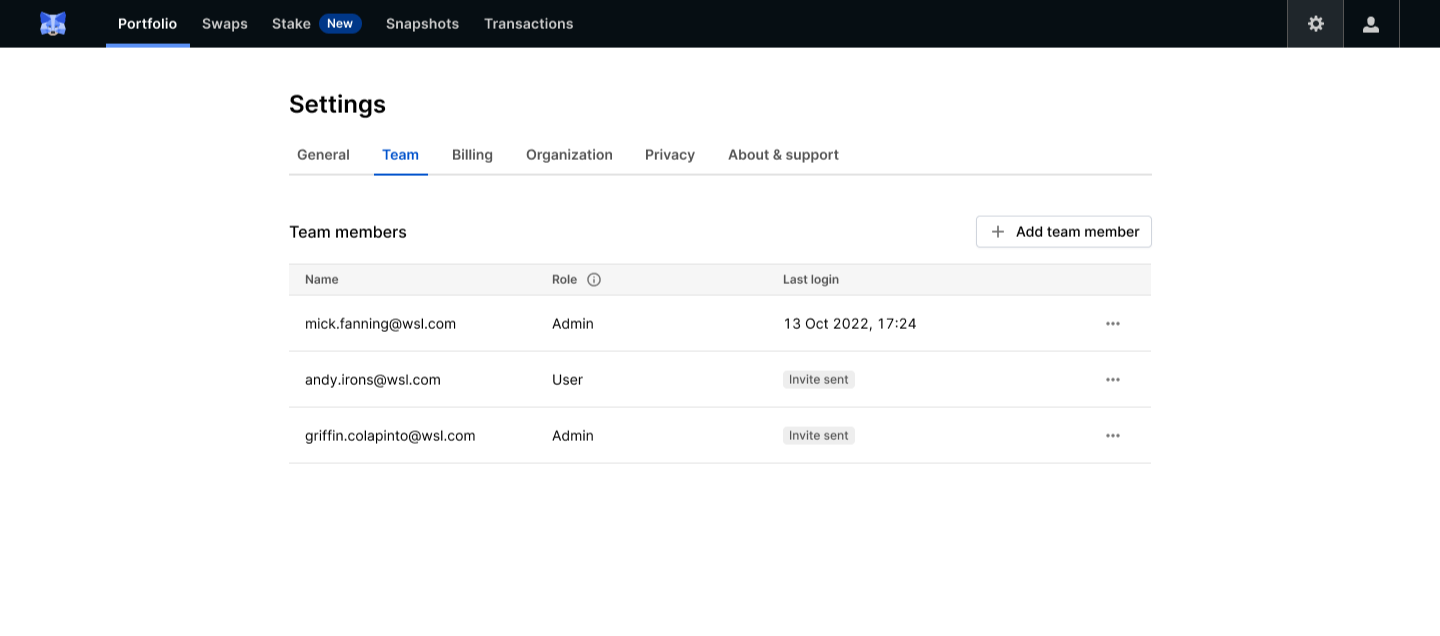

User management

Organization administrators are now able to add, edit and delete users from their organizations -- to allow for easy team management.

SOC II Type 1 Certification

MMI successfully achieved the System and Organization Controls (SOC) 2 Type I certification.

The First Institutional Staking Marketplace

ConsenSys Launches the First Marketplace for Institutional Staking on MetaMask Institutional, in Partnership with Allnodes, Blockdaemon, and Kiln. Read more here.

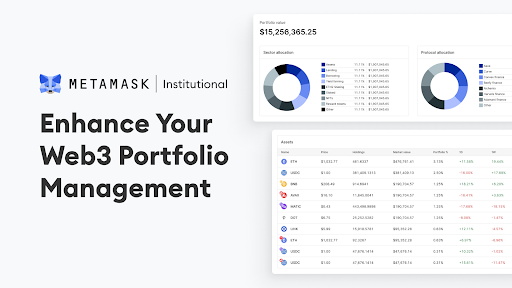

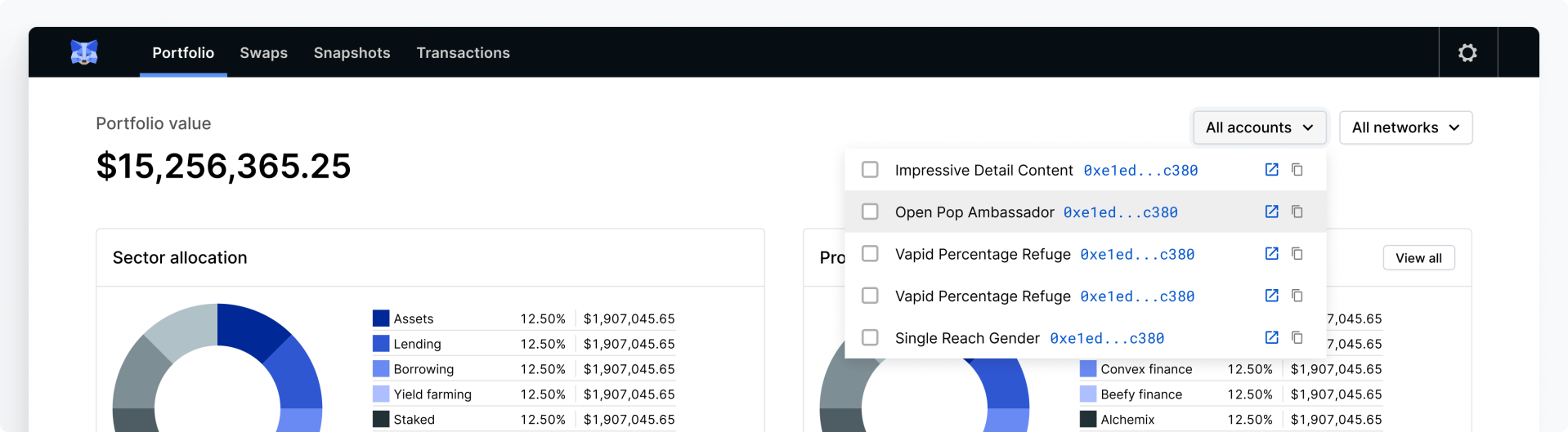

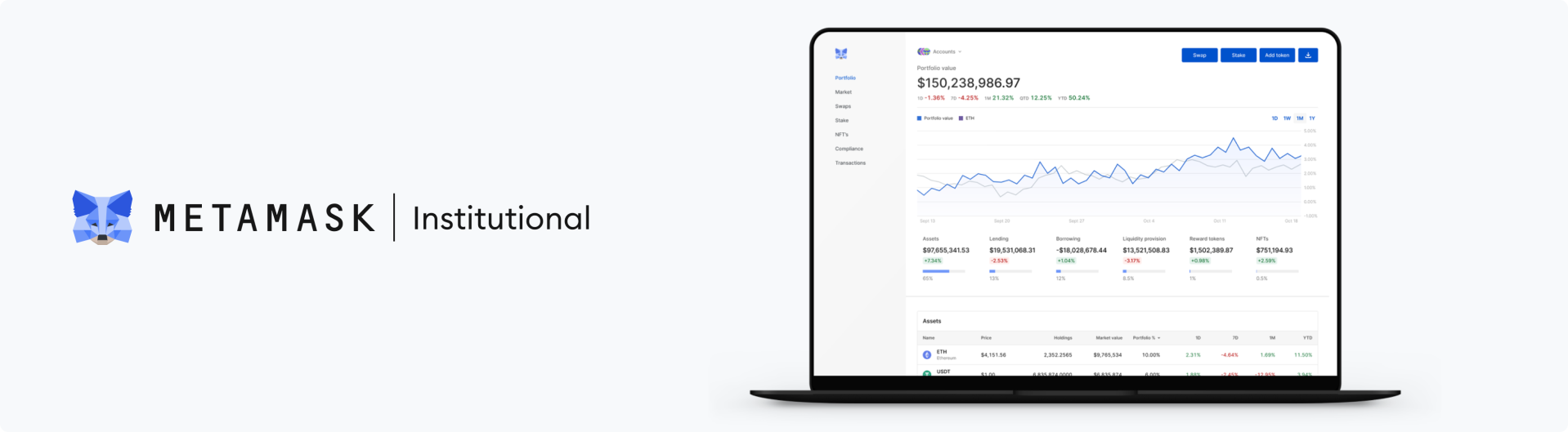

...and a more powerful Web3 Portfolio Dashboard

MMI’s upgraded portfolio dashboard offers a range of cutting-edge tools—including portfolio management, digital asset monitoring, in-depth transaction reporting, and institutional controls—that will enable organizations to better manage how they interact with web3.

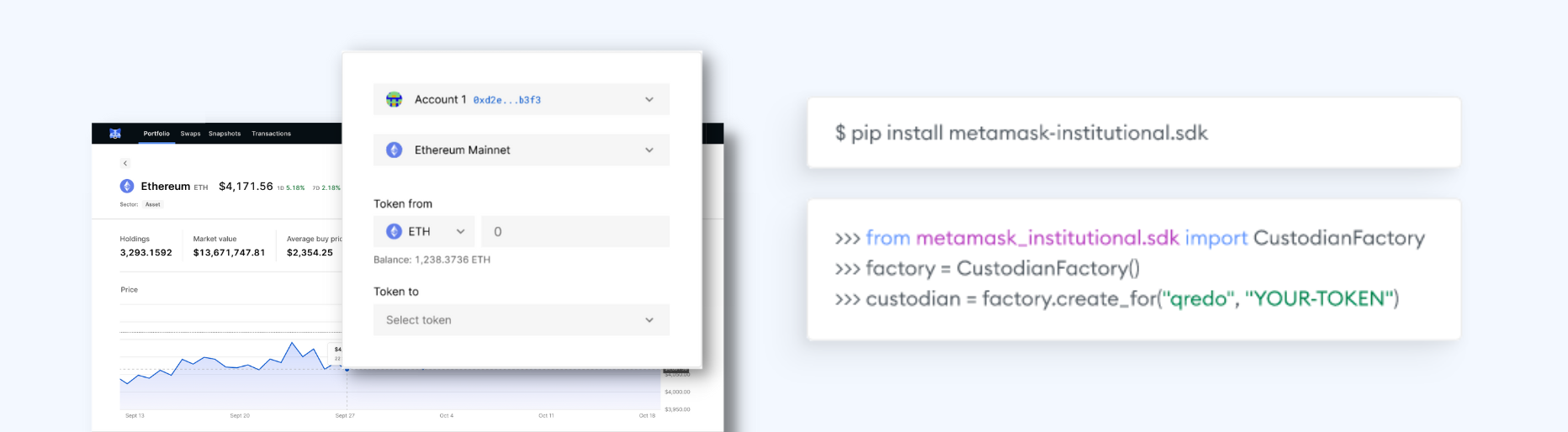

Launch of programmatic access. And swaps on the Portfolio Dashboard.

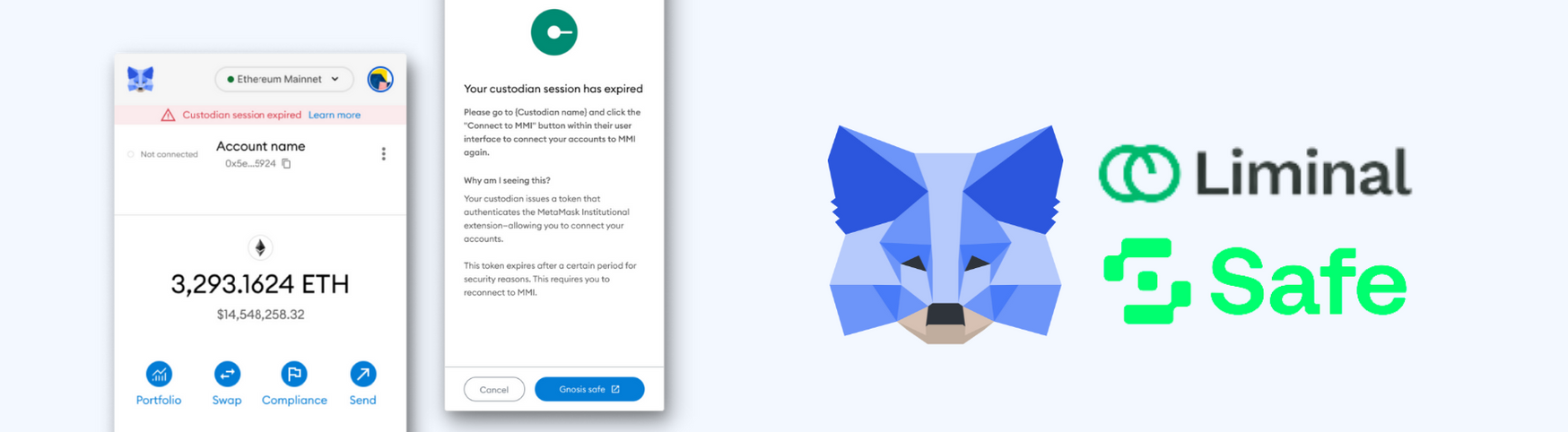

Safe and Liminal go live on MMI. And updates to our extension infrastructure and custodian integration documentation.

Floating Point Group live on MMI

As of this month, 6 out of our 11 custodian partners are live on MetaMask Institutional.

Announcement of 3rd set of custodian integrations bringing total partners to eleven

With the newest four custodians, MMI expands its geographical footprint with Cobo, Liminal and Propine in Asia and MENA, and FPG in the US.

Other product updates in September 2022

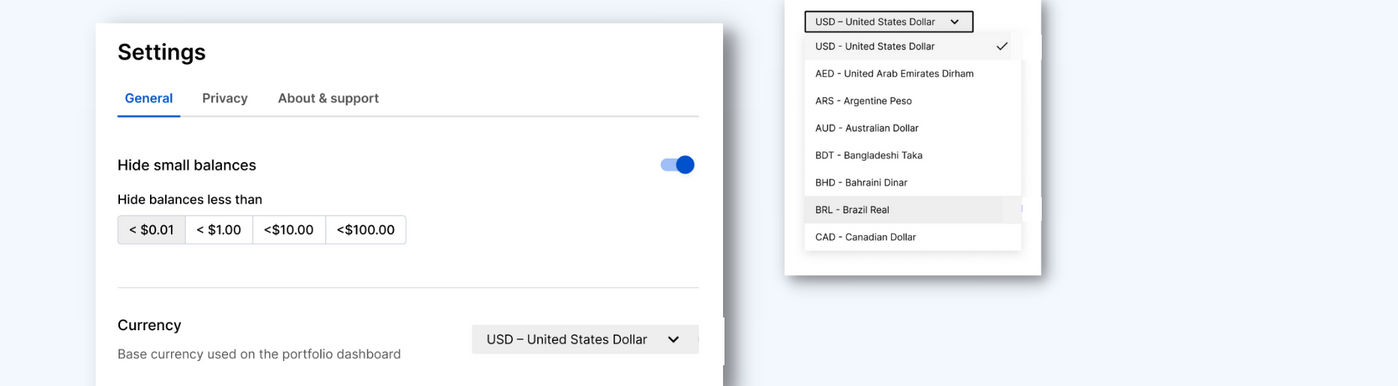

Updates to Portfolio Dashboard reporting and UI

The Portfolio Dashboard now provides consolidated reporting across 13 EVM chains:

Launch of new reporting features including Snapshots and Transaction Notes

MMI introduces Snapshots and Transaction Notes to help organizations save time, decrease the likelihood of error, and make monitoring and reporting easier.

Improvement of charts for faster rendering, and addition of sector and protocol allocation

These changes enable MMI users to see an asset allocation breakdown of their portfolio.

Addition of network filtering to within the Portfolio Dashboard

Users are now able to filter their portfolios by different networks.

“The second quarter of 2022 was a profound period for MMI. Despite crypto markets falling 60% on average, we continued to grow double digits week-on-week throughout the period. In this quarter, we announced our next set of custodian partners; attended the Paris Blockchain Summit, Crypto Bahamas, Permissionless, Consensus, Battlefin, NFT.NYC and ETH NYC; and won a Hedgeweek award. We ran our first Twitter space and spoke on several different podcasts. We also held the first MMI Offsite. Most importantly and fundamentally, we shipped meaningful features with great user experiences to solve the most salient needs for our user. Hence, this update reflects all the incredible work of the entire MMI team.” —Johann Bornman, Global Product Lead for MetaMask Institutional

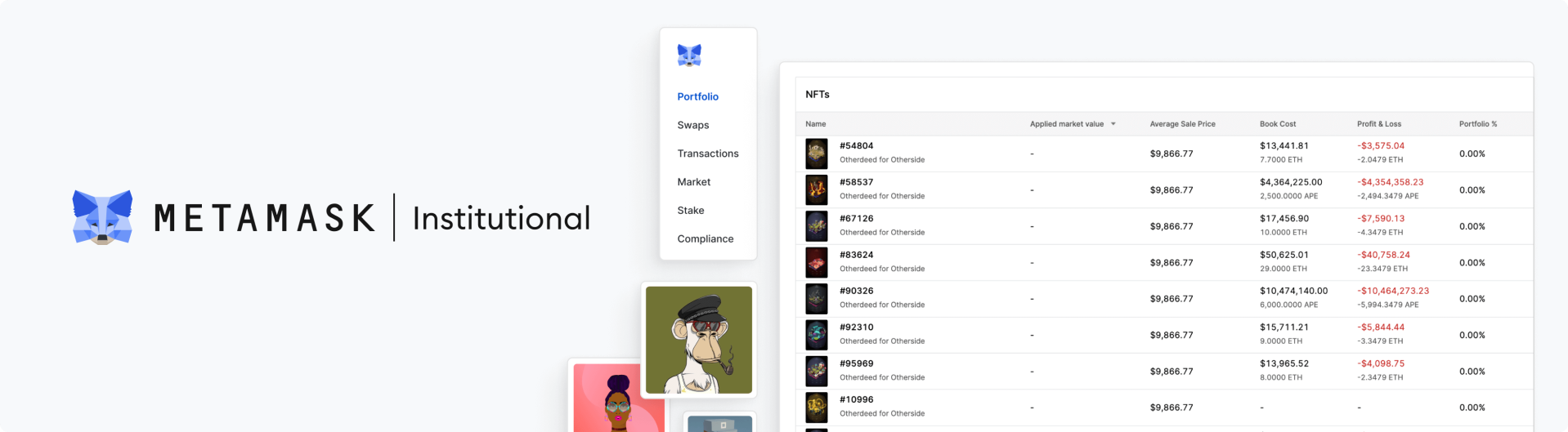

Launch of NFT tracking functions within Portfolio Dashboard

The NFT feature on the MMI Portfolio Dashboard enables organizations to view detailed metrics for NFTs held across different custodians, accounts, and marketplaces.

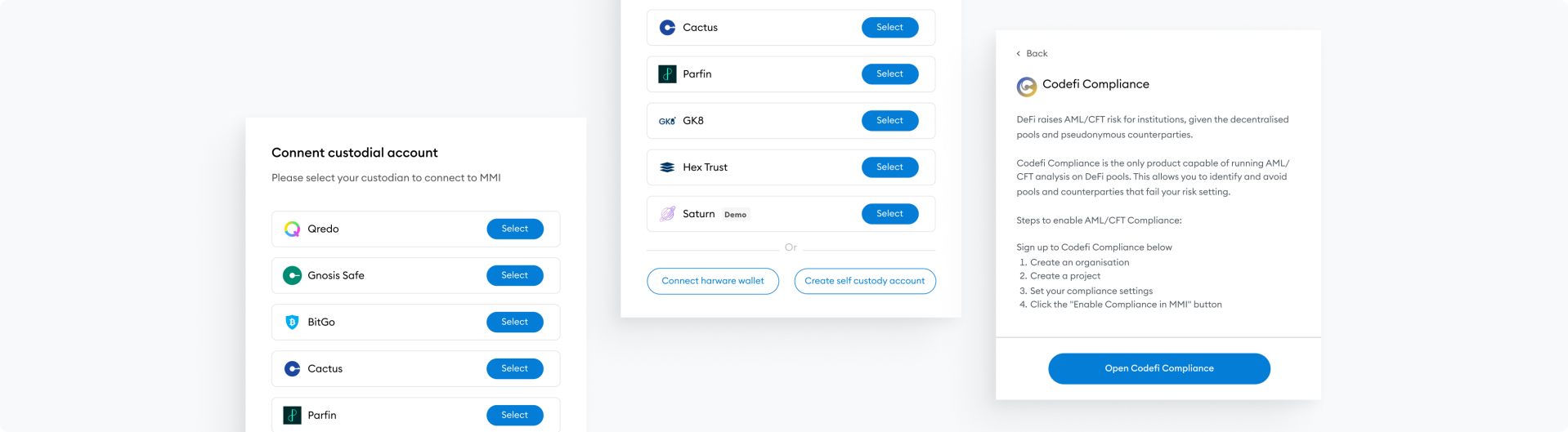

Redesign of our custodial connection and compliance pages

The changes incorporate sleeker design and create a smoother user experience.

Addition of account filtering functionality in the Portfolio Dashboard

Users are now able to filter their portfolios by different accounts and strategies.

MMI partnerships with self-custody solution Gnosis Safe and GK8 and custodians like Hex Trust and Parfin positions the decentralized finance (DeFi) wallet as the primary Web3 gateway for organizations worldwide, with unrivaled access to DeFi in many jurisdictions with different key management requirements. With seven integrated custodians to date, MMI has now expanded its offering to best accommodate the specific custody requirements of DAOs, expanding its offering beyond crypto funds and traditional finance (TradFi) to more crypto native institutions.

Over the quarter the MMI product team delivered on three key initiatives; All with the aim to increase the number of bridges and fortify them with institutional features.

The MMI DeFi and Web3 portfolio dashboard is an expanded investor interface that provides a holistic overview of an organization’s portfolio, portfolio performance, individual assets, and historical transactions.

“The Portfolio Dashboard is an institutional canvas created by the MMI team. It allows us to solve the most important needs for organisations, build a rich and tailored product and user experience, and rapidly innovate within DeFi and Web3 ”—Johann Bornman, Product Lead of MetaMask Institutional

MMI launches custodian account multi-chain capabilities. This brings four important benefits to the crypto funds, trading desks, market makers, and other organizations working with MMI:

There it is: Web3 access and bridging across multiple EVM chains.

“MetaMask Institutional works with crypto funds, market makers, prime brokers, hedge funds and custodians across the globe. Given the sophisticated needs of our users, we think deeply about the entire transaction-flow process for crypto institutions—from onramps, custody, research and pre-trade compliance, to execution, yield, analytics, monitoring and reporting—a capital allocation stack mental model if you will.

Within this capital allocation stack, we focus on two core principles: First, partnering with world-class businesses to address our users’ needs; and second, where we at ConsenSys, can provide unique value to our users and partners.” —Johann Bornman, Global Product Lead of MMI

This is a review of the steps we’ve taken in each quarter of 2021 across this capital allocation stack.

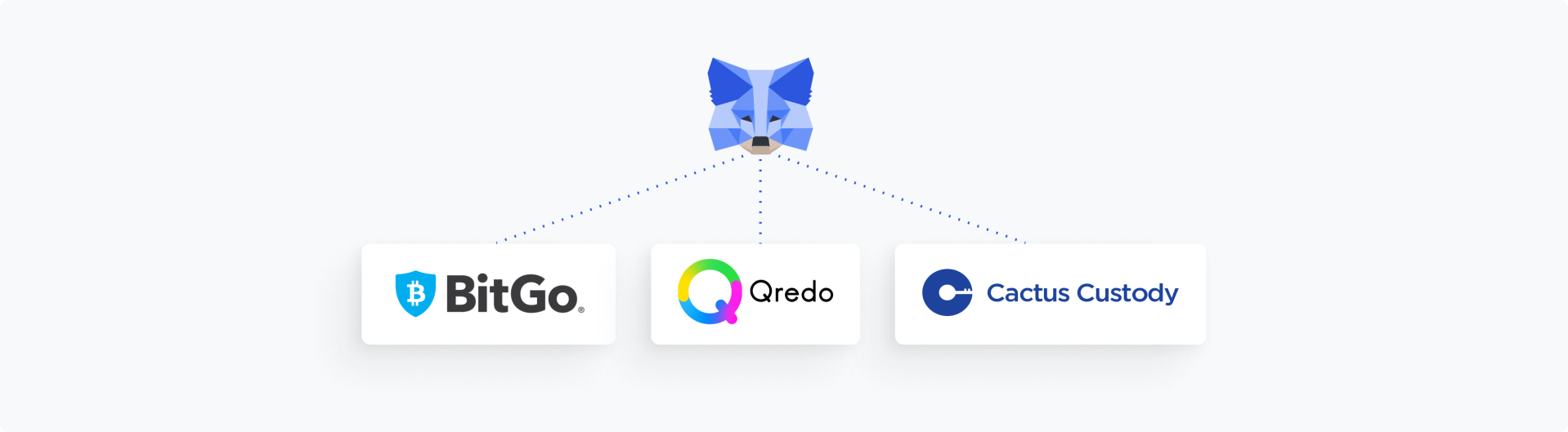

MMI partners with custodians BitGo, Qredo, and Cactus Custody™ to provide small and large organizations with access to DeFi that fulfills institution-required security, operational efficiency, and compliance needs.

ConsenSys forms the Cryptoeconomic Research team—a formation of experts generating analysis and content focusing on token engineering, DAO and Web3 participation, and on-chain investment strategy.

MetaMask Institutional is launched as the institution-compliant version of the world’s most trusted DeFi wallet, MetaMask. MMI becomes the DeFi wallet and Web3 gateway for cryptofunds, market makers, and trading desks—offering unrivaled access to the DeFi ecosystem with institution-required security, operational efficiency, and compliance. MMI enables funds to trade, stake, borrow, lend, invest, bridge assets, and interact with over 17,000 DeFi protocols and applications.